Revolutionize Your Digital Commerce with Rebilling.com

Seamless Payments, Smarter Decisions, Stronger Growth

Tired of the hassle of international payments? Rebilling's got your back!

Empower your company to accept payments across 126+ countries using over a hundred payment methods, all while receiving collections in the country where it’s legally registered.

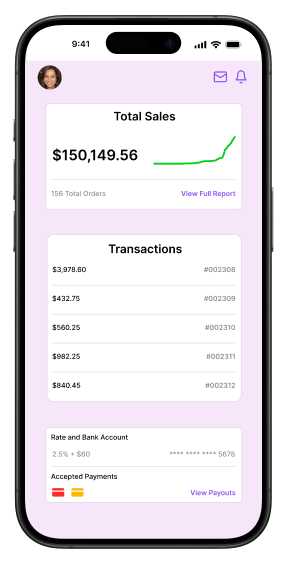

Increased reporting capabilities.

Better risk mitigation.

Improved payment approval rates.

Accepts cards, digital wallets, bank transfers and cash.

Unlock Your Business Potential

Streamlined Operations, Maximized Revenue with Rebilling

Rebilling: Tailored for Your Success

Empowering Merchants and Operators Alike

-

1

Comprehensive Payment Solutions

-

2

User-Friendly Setup

-

3

Advanced Tools

-

4

Security and Compliance

-

1

Efficient Oversight

-

2

Scalable Solutions

-

3

Customization

-

4

Streamlined Operations

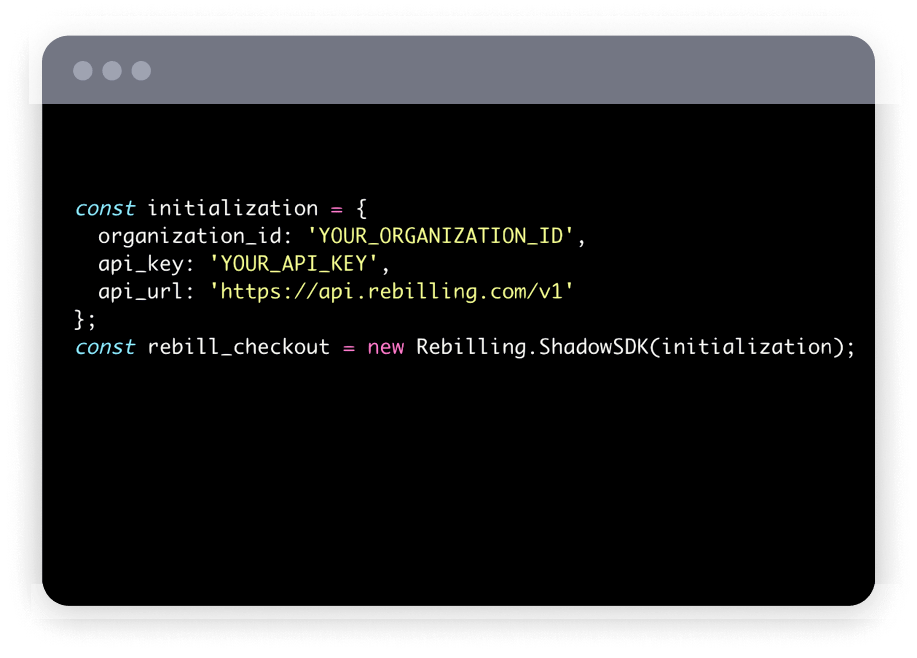

Seamless SDK Integration in Hours

Create advanced payment and billing experiences effortlessly, with minimal coding.

- Payment Link Integration

- Checkout Integration

- Web Elements (JS)

- Mobile Elements (iOS, Android, React Ntive)

How It Works?

Easy Setup:

1

- Create your Rebilling account

- Configure your digital outlets (websites, apps)

- Connect your preferred payment gateways

Customize Your Payment Flow:

2

- Design your payment forms or use templates

- Set up product catalog and pricing strategies

- Configure recurring payment plans

Implement Intelligent Routing:

3

- Define routing rules

- Let our ML-powered system optimize transaction success rates

- Automatically route payments through the best channels

Enhance Security:

4

- Activate fraud prevention tools and risk analysis

- Set up blacklist rules and velocity checks

- Implement 3D Secure for added transaction security

Optimize Marketing Performance:

5

- Integrate with your marketing platforms

- Track detailed conversion and sales metrics

- Monitor customer lifetime value and recurring payments

Manage Operations:

6

- Handle orders, refunds, and customer support from one dashboard

- Utilize our notification system for timely communications

- Generate insightful reports for business intelligence

Scale and Grow:

7

- Easily add new products, payment methods, or outlets

- Expand to new markets with our global payment support

- Leverage our multi-tenancy architecture for efficient growth

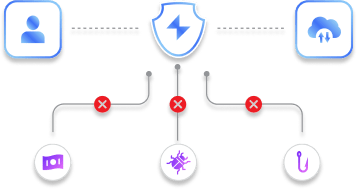

Fort Knox for Your Finances

Bulletproof Security, Effortless Compliance with Rebilling

Advanced Fraud Prevention

- Implement customizable blacklist rules for emails, card numbers, and more

- Utilize velocity checks to prevent suspicious rapid-fire transactions

- Leverage our risk mitigators to analyze card and customer details

Intelligent Risk Analysis

- Access real-time risk scoring for every transaction

- Benefit from machine learning algorithms that adapt to emerging threats

- Gain insights into potential risks with our comprehensive dashboard

Secure Data Handling

- Enjoy end-to-end encryption for all sensitive data

- Benefit from tokenization to protect customer payment information

- Rest easy with our secure, PCI-compliant infrastructure

GDPR and Data Privacy

- Ensure customer data privacy with GDPR-compliant processes

- Implement data minimization and purpose limitation principles

- Provide customers with control over their personal information

PCI DSS Compliance

- Operate within our PCI DSS Level 1 certified environment

- Minimize your PCI scope with our secure payment handling

- Access tools and guidance for maintaining your own PCI compliance

Global Regulatory Adherence

- Stay compliant with region-specific regulations worldwide

- Automatically adapt to changing compliance requirements

- Reduce the burden of managing multiple regulatory frameworks

Advanced Fraud Prevention

- Implement customizable blacklist rules for emails, card numbers, and more

- Utilize velocity checks to prevent suspicious rapid-fire transactions

- Leverage our risk mitigators to analyze card and customer details

Intelligent Risk Analysis

- Access real-time risk scoring for every transaction

- Benefit from machine learning algorithms that adapt to emerging threats

- Gain insights into potential risks with our comprehensive dashboard

Secure Data Handling

- Enjoy end-to-end encryption for all sensitive data

- Benefit from tokenization to protect customer payment information

- Rest easy with our secure, PCI-compliant infrastructure

GDPR and Data Privacy

- Ensure customer data privacy with GDPR-compliant processes

- Implement data minimization and purpose limitation principles

- Provide customers with control over their personal information

PCI DSS Compliance

- Operate within our PCI DSS Level 1 certified environment

- Minimize your PCI scope with our secure payment handling

- Access tools and guidance for maintaining your own PCI compliance

Global Regulatory Adherence

- Stay compliant with region-specific regulations worldwide

- Automatically adapt to changing compliance requirements

- Reduce the burden of managing multiple regulatory frameworks